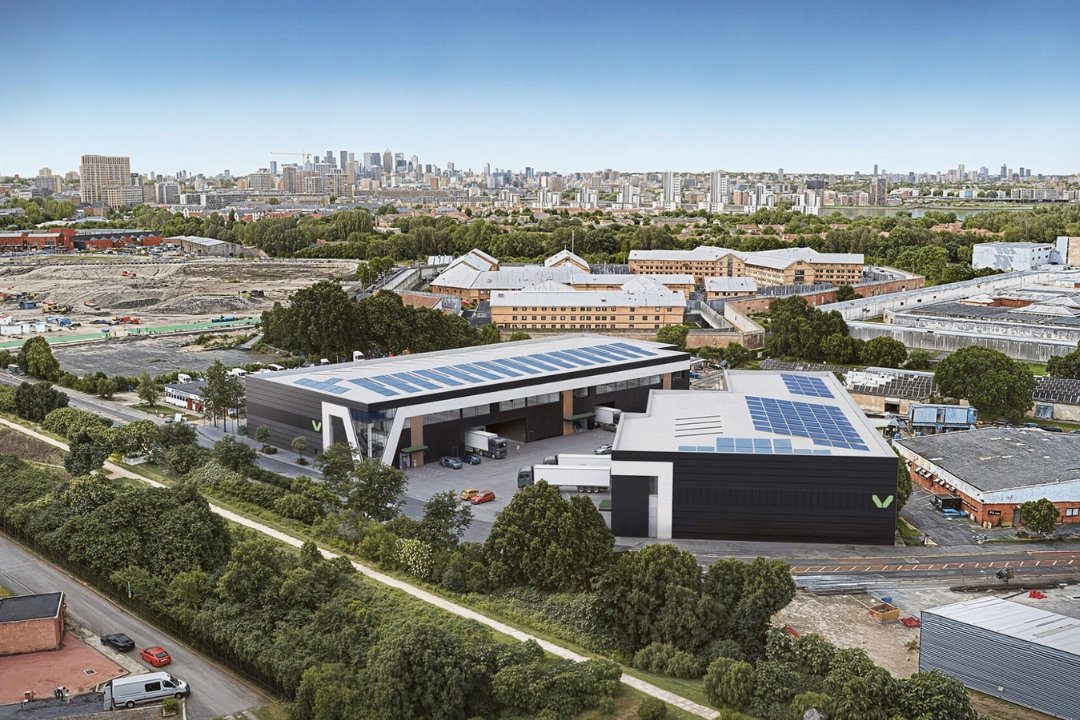

Real estate developer Verdion and Industrial Property Investment Fund (IPIF), managed by Legal & General (L&G), have secured a new urban logistics development site in the London Borough of Greenwich. The site sits within the West Thamesmead Opportunity Area.

The agreement marks the first partnership between Verdion and L&G. Verdion will take responsibility for developing the site, which L&G will own as the ultimate asset manager.

The 2.6-acre brownfield opportunity is located on Nathan Way, which forms part of the West Thamesmead Strategic Industrial Location (SIL) and Plumstead Industrial Area. The scheme has an anticipated Gross Development Value (GDV) of £30 million.

The land will be developed speculatively to create a best-in-class urban logistics scheme. The plan optimises the site’s location by providing 78,987 sq ft of new floorspace. This will be divided into six small to mid-box units, ranging from approximately 7,500 to 18,000 sq ft.

The scheme will feature stringent environmental and sustainability targets. It aims to achieve BREEAM Excellent/ EPC A+ ratings. It will also include a whole-life carbon focus, high energy performance and resilience, biodiversity positive measures, and supply chain social safeguards.

The site’s connectivity is crucial, being located 5.3 miles east of the Blackwall and Silvertown Tunnels and 8.9 miles from the M25 motorway. It is near several other major developments, including Berkeley Homes and Peabody’s 1,900 home Lombard Square development.

This acquisition aligns with Verdion’s UK-wide urban logistics strategy. This strategy targets brownfield redevelopment opportunities with strong environmental, social, and governance (ESG) credentials close to major population centres.

Mark Garrity, Development Director UK at Verdion, commented on the significance of the deal. He stated: “This acquisition is a significant milestone for our UK strategy, and its Thamesmead location sets a clear standard for Verdion’s future acquisition programme. High levels of demand are anticipated, both from displaced occupiers further north and west, and from new tenants attracted by inner South East London’s improved transport links. Our masterplan has been optimised to accommodate a wide range of sizes and uses to capitalise on this geographic shift and we are now ready to move forward with these speculative development plans targeting Q2 2027 completion.”

Matt Lilley, Assistant Fund Manager on IPIF and Head of Industrial Development Strategies, spoke for L&G. He said: “The acquisition of Nathan Way reflects our strategy of allocating to high growth industrial sub-sectors such as urban logistics, and allows us implement net zero-carbon credentials from day one, future proofing the asset and providing high quality accommodation to an undersupplied London sub-market.”

![[IRHM] logo](https://irhmagazine.com/wp-content/uploads/2025/08/IRHM-AWARDS-2025-1024x683.jpg)