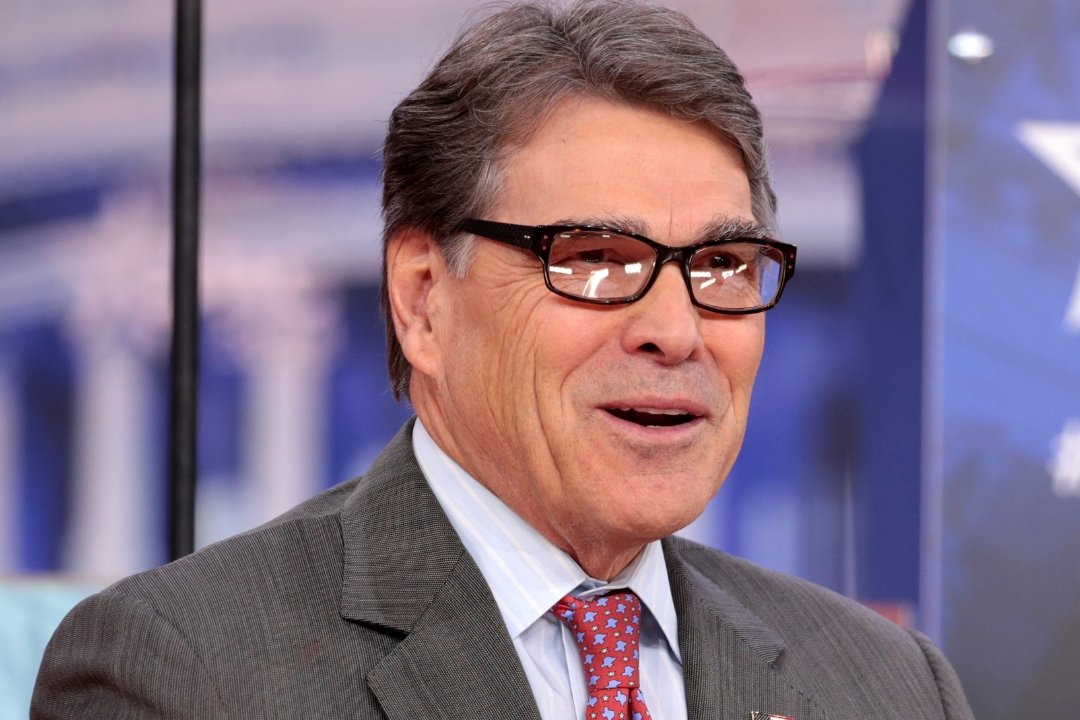

Fermi, a data centre real estate investment trust co-founded by former U.S. energy secretary Rick Perry, has secured $682.5 million through its U.S. initial public offering (IPO), as investor appetite for AI-related infrastructure continues to accelerate.

The Texas-based firm, established in January 2025, sold 32.5 million shares priced at $21 each, falling within its marketed range of $18 to $22 per share. The offering gives the company a market valuation of $12.46 billion.

Fermi is developing what it says will become the world’s largest combined energy and data campus in Amarillo, Texas. The site is designed to draw on nuclear, natural gas, and solar power to supply dedicated energy infrastructure for hyperscale clients, businesses that require enormous computing power and storage capacity.

Shares are set to debut on the Nasdaq on 1 October under the ticker symbol “FRMI,” with a secondary listing on the London Stock Exchange scheduled for 2 October.

The firm had initially planned to sell 25 million shares but raised the size of the offering to 32.5 million earlier this week, a move seen as a response to strong investor demand.

“There’s no questioning that they’re selling into a lot of demand for AI infrastructure right now,” said Matt Kennedy, senior strategist at Renaissance Capital, which specialises in IPO-focused research.

Fermi joins a number of data centre operators that have attracted considerable attention from investors this year. Companies such as CoreWeave (CRWV.O) and WhiteFiber (WYFI.O) have also seen their shares trade well above initial offering prices.

Despite the strong debut, the company remains in an early phase of development. It reported a $6.4 million loss from its inception through 30 June and does not expect to generate revenue in the next 12 months. According to company projections, its Amarillo facility could deliver up to 11 gigawatts (GW) of power to data centres by 2038, with 1 GW due to come online by late 2026.

UBS Investment Bank, Evercore ISI, Cantor and Mizuho acted as joint bookrunners for the offering.

![[IRHM] logo](https://irhmagazine.com/wp-content/uploads/2025/08/IRHM-AWARDS-2025-1024x683.jpg)