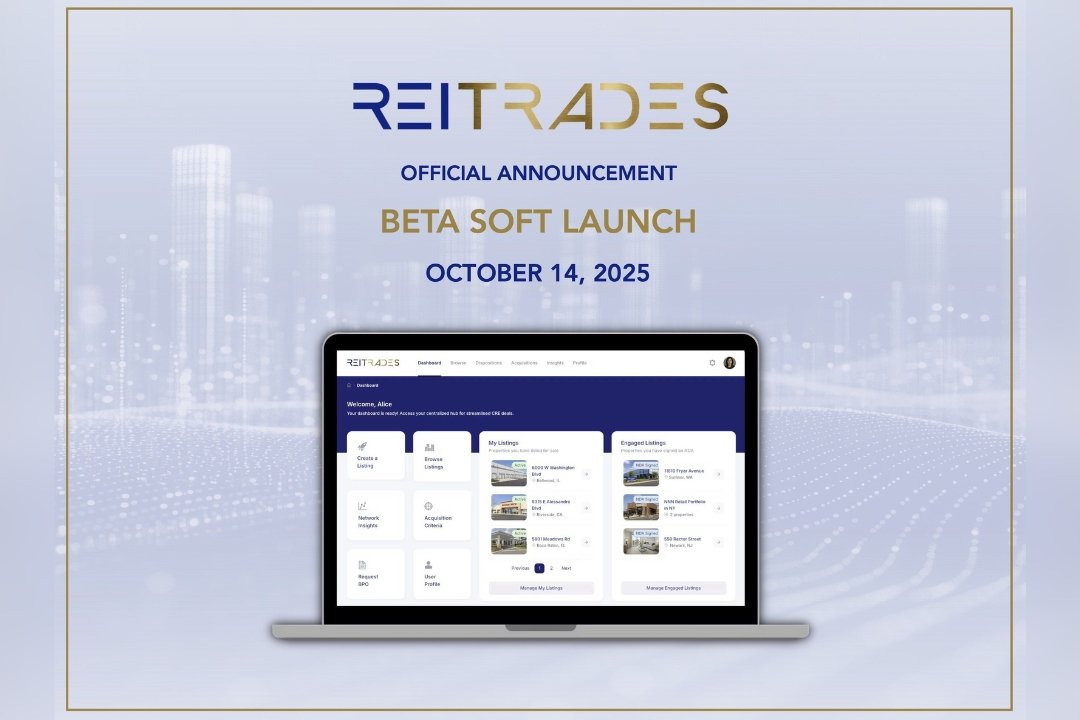

The digital commercial real estate marketplace REItrades has officially entered its beta phase, marking its soft launch on October 14 with more than $120 million worth of institutional commercial real estate assets listed exclusively for sale on the platform. The initial rollout includes a select group of investment properties valued above $10 million, spanning multiple asset classes and locations across the United States.

REItrades positions itself as a principal-to-principal marketplace designed to transform how institutional commercial real estate transactions are conducted. The platform integrates an AI-powered marketing engine with an end-to-end automated digital workflow, aiming to streamline and modernize a sector traditionally dominated by brokerage-led deals. With a growing network of more than 5,800 decision-makers from 3,300 pre-vetted institutional real estate investment organisations (GPs), REItrades connects sellers directly to the most qualified institutional buyers.

According to the company, this direct-to-seller structure has already shown significant demand from institutional sellers seeking greater transparency and efficiency. The platform allows users to create and track listings, manage deal flow, analyse buyer activity, and browse active opportunities within a single interface. It marks what REItrades calls a “major milestone” in an industry increasingly eager to move away from costly and time-consuming brokerage processes.

Historically, commercial real estate sales have been heavily relationship-driven, relying on brokers to connect sellers with limited pools of buyers. However, REItrades’ founders argue that the industry’s shift towards data-driven decision-making has diminished the traditional broker’s influence. With investors now able to access detailed property data, valuations, and financial metrics independently, the need for intermediary-driven sales processes is declining.

In conventional high-value transactions, brokers often market assets only within their own small circle of potential buyers, a system that, while personal, can restrict exposure to a broader institutional audience. Conversely, open marketplaces often attract unqualified buyers, diluting the attention of serious investors. REItrades aims to bridge this gap by combining automation, exclusivity, and precision marketing in a controlled environment for verified professionals.

The platform also offers a range of digital tools designed to make transactions more seamless. Buyers can instantly e-sign NDAs to access offering memoranda (OMs), contact sellers directly through a private chat feature, and submit or negotiate offers in real time. Sellers, meanwhile, can monitor engagement, respond with counteroffers, and request introductions within the same secure platform. All transaction activity is recorded and available for both parties to track within the system, creating an auditable and efficient process.

The commercial real estate sector has long struggled with illiquidity due to high transaction costs and lengthy timelines. REItrades’ founders believe the marketplace represents a meaningful step toward a more liquid and efficient institutional sales environment. By digitising workflows and leveraging automation, the platform promises to lower barriers and enhance transparency for both buyers and sellers.

![[IRHM] logo](https://irhmagazine.com/wp-content/uploads/2025/08/IRHM-AWARDS-2025-1024x683.jpg)